If you thought we’d already had all of the big M&A announcements for this year, you’d be justified in thinking so. But you’d also be wrong…

IGT and Everi

On 26 July, IGT and Everi announced that they would be acquired by Apollo Global Management in a deal valued at $6.3bn.

Everi stockholders will receive $14.25 per share and IGT will take $4.05bn for IGT Gaming, which the company expects to use “to repay debt and to be returned to shareholders.”

However, it’s not going to be a clean one-and-done deal, as IGT is also separating part of its business prior to the deal – something that was agreed upon as far back as February of this year.

The company will split into IGT and IGT Gaming, the latter handling its gaming and digital businesses. IGT Gaming will be treated as a taxable spin-off to IGT shareholders before being officially acquired by Apollo. The previous agreement, which would see IGT combine with Everi, has been terminated and the two will continue as privately owned companies as part of one combined enterprise.

“Under private ownership, we believe we will be better positioned to accelerate the integration of our two organisations for the benefit of our customers and employees” – Randy Taylor, Everi President and CEO

Once IGT Gaming is integrated with Apollo, IGT will change its name and its stock ticker symbol as it redirects its focus solely to its lottery business.

Of course, IGT is no stranger to major acquisitions. In 2014, GTech bought IGT for $6.4bn; comprised of $4.7bn in cash and $1.7bn in debt. IGT shareholders received $18.25 per share and after the two combined, the Gtech name was dropped and as you can likely imagine, the IGT name was carried forward.

In that merger, the companies hoped that by “joining IGT’s leading game library and manufacturing and operating capabilities with GTech’s gaming operations, lottery technology and services” it would lead the company to success – which, objectively, is what happened.

But what will come from this new merger between IGT, Everi and Apollo?

Interestingly enough, two of the three respective speakers highlighted the importance of going private, something we’ve also discussed at length here at Gambling Insider.

Randy Taylor, Everi President and CEO, said: “Under private ownership, we believe we will be better positioned to accelerate the integration of our two organisations for the benefit of our customers and employees.”

Meanwhile Daniel Cohen, Partner at Apollo, commented: “We strongly believe in the value proposition of the combination and are confident these complementary gaming platforms will be even better positioned under private ownership to capture the opportunities ahead to grow and create value.“

The previous agreement, which would see IGT combine with Everi, has been terminated and the two will continue as privately owned companies as part of one combined enterprise

The only business that didn’t mention it was IGT. Instead, Vince Sadusky, IGT CEO focused on how “this transaction will allow IGT Gaming to continue to invest in and enhance its growing core segments while providing customers with a more comprehensive portfolio of offerings.”

So, how much did the ability to go private sway the deal? We may never know, but it’s certainly no coincidence either. The one thing we can say for certain is that we can expect to see IGT Gaming evolve in a similar way that Light & Wonder did after it split from Scientific Games.

Bally’s

Soo Kim, Managing Partner of Standard General and Chairman of Bally’s, made no secret of his plans to acquire the operator after he joined the Board of Directors years ago. They’ve been stuck in a will-they-won’t-they situation that’s caught the eye of many in the industry.

It’s also impossible to discuss this story without mentioning that throughout this, Bally’s has rejected several offers from Standard General, including one in 2022 at $38 per share.

Last week, it was confirmed that Bally’s will be acquired at $18.25 per share when Bally’s agreed to a merger valued at $4.6bn.

So was it worth holding out all that time, in the hopes that it could do better than $38 per share?

Well, maybe. Only one year earlier, in 2021, Bally’s share price was $73.63 – so it was probably difficult for the special committee to swallow a 48% decrease in perceived value in such a short period of time. It would also explain the outcry when Standard General then offered $15 per share earlier this year.

“The transaction provides Bally’s stockholders with a significant cash premium along with certainty of value for their investment or, if they elect to retain their shares, the opportunity to participate in the longer-term growth prospects of our expanded portfolio and significant development pipeline” – Soo Kim, Managing Partner at Standard General

Third time’s a charm, but what now for Bally’s?

While talks of an acquisition were ongoing, there were rumours floating around that Bally’s wouldn’t be able to complete its Chicago casino project – to the point where even Chicago Mayor Brandon Johnson expressed his doubts about it.

However, just before the merger was announced, Bally’s managed to secure a $2.07bn funding deal with GLPI which will put the development back on track. As part of this, Bally’s will lease the property from GLPI at $20m a year, Bally’s Kansas City and Bally’s Shreveport casino at $32.2m in annual rent and GLPI will also have the choice to buy and lease back Bally’s Twin River Lincoln Casino in Rhode Island before the end of 2026.

Another major factor is the combined company moving forward as a publicly traded business under the Securities Act of 1934. Due to the company staying public, shareholders can keep their holdings through a rollover election. Sinclair Broadcast Group and Noel Hayden have confirmed that they will hold, meaning that at least 47% of Bally’s shares will be rolled over into the combined company.

Ultimately, we could see Kim work his magic again. He’s been widely credited for leading Bally’s through a period of great expansion after joining the Board when the company (then called Twin Rivers) had just filed for bankruptcy and closed several properties and into the casino behemoth it’s known to be today.

It’s not beyond the realm of possibility that he could do it once again. Indeed, since the announcement, the Bally’s share price is the highest it’s been in over 12 months. It’s up 4.3% when compared to the same period last year, up 42.5% from six months ago and 23.5% this past week alone.

Sinclair Broadcast Group and Noel Hayden have confirmed that they will hold, meaning that at least 47% of Bally’s shares will be rolled over into the combined company

Soo Kim, Managing Partner of Standard General, said: “The transaction provides Bally’s stockholders with a significant cash premium along with certainty of value for their investment or, if they elect to retain their shares, the opportunity to participate in the longer-term growth prospects of our expanded portfolio and significant development pipeline.”

Sega Sammy

Sega Sammy’s recent acquisitions have definitely been interesting.

GAN was acquired in November 2023 for $107.6m, which raised a few eyebrows, but it was the recent purchase of Stakelogic for €130m ($140.8m) that really turned heads.

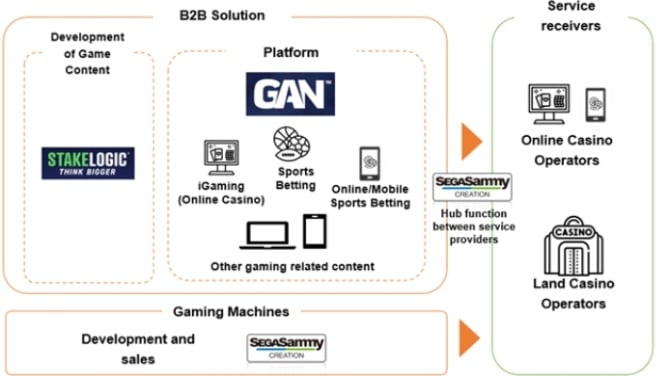

As for what Sega Sammy intends to do with it, this is explained best by the infographic released alongside its announcement.

The predicted workflow between Stakelogic, GAN and Sega Sammy to deliver content to North American operators

While some Japanese gaming companies, mainly Nintendo, like to maintain a strict family-friendly image, it seems Sega is starting to deviate from that quite significantly.

While it’s unlikely that we’ll see any Stakelogic live casinos dressed as Sonic as they spin the roulette wheel, it’s certain that Sega will leverage its branding on future gaming releases.

Despite the restrictions in Japan against gambling, Sega Sammy has been a major presence in the legal pachinko scene. Its latest products anime-branded pachislots and pachinko machines, have seen over 100,000 installed units since they were launched last year.

The company also saw record high income from its Paradise Sega Sammy casino resort in South Korea, noting a 162% increase in gross profit to KRW 95.5bn ($69m), while net profit grew 183% to KRW 28bn and EBITDA almost doubled from KRW 65.3bn to KRW 103.7bn.

In its FY2023 report, it indicates that its new medium-term plan revolves around ‘making “Gaming Business” as a new segment’, defined by ‘online gaming, development, manufacturing, and sale of slot machines by Sega Sammy Creation [and the] operation business of integrated resort facility by Paradise SegaSammy. The plan is to enter ‘the online gaming market in North America, which is expected to grow further in the future, and aiming to establish it as the third pillar of our business.’

“We believe that the combination of these outstanding technologies and gaming content with the customer network of [Sega Sammy], which has been providing quality gaming content and equipment to North American land casino operators, is expected to create synergies and contribute significantly to the expansion of our gaming business” – Sega Sammy on acquiring GAN and Stakelogic

The company plans to ‘revitalise the pachislot and pachinko industry’, which includes several major anime titles getting their own machines; mainly Tokyo Revengers, Lycolis Recoil and Bofuri.

While it’s unlikely that we’ll see any Stakelogic live casinos dressed as Sonic as they spin the roulette wheel, it’s certain that Sega will leverage its branding on future gaming releases.

Despite being one of the most unlikely contenders for the North American market, it seems like Sega Sammy has the strategy, the drive and the means to pull it off.