Listen To Article

Listen To Article

Rush Street Interactive (RSI) has released its Q3 2023 results. The results have shown an overall positive uptick for the company, whose revenue was up 15% from Q3 2022, however the results also revealed that the company is still operating at a net loss.

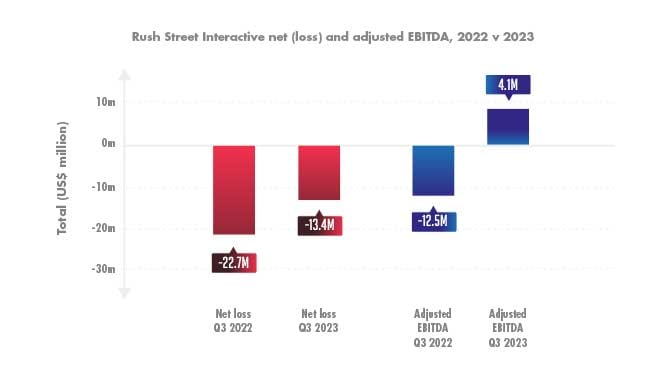

In Q3 2022, RSI was operating at a net loss of $22.7m, with an adjusted EBITDA of a minus $12.5m. In Q3 2023, the net loss reduced to $13.4m, which is an improvement of 41%. In fact, this reduction in net loss resulted in Q3 2023 experiencing a gain in adjusted EBITDA, at $4.1m.

Operating costs were up for RSI, with adjusted operating costs and expenses having increased from $164.5m in Q3 2022, to $174.2m in Q3 2023. This is an increase just shy of 6%; reflecting both an increase in expenditure and the current inflation rate of the dollar.

Other notable metrics from RSI’s Q3 report include a decrease in advertising and promotion costs by 23%. Yet in spite of reduced advertising costs, average revenue per monthly active user was up 8% year-over-year, with the average monthly revenue from customers in the US and Canada being $374.

Stock prices for RSI have been on the rise in the past week leading up to Q3 results day, with stock prices sitting at $3.54 as of the time of writing.

On the results, Rush Street Interactive CEO, Richard Schwartz said: “Thanks to our decade-long investment in technology and a customer-centric approach, we’ve positioned ourselves as a top five online operator in the US. Our third quarter results affirm our ability to deliver on both counts as we continue to acquire, engage and retain customers.”